Relationship Between Crude Oil Prices and Exchange Rate

After the first oil shock in 1973 which shook the world economy, the attention of everyone turned to the oil prices. Changes in oil prices began to be followed closely, and its effects over macroeconomic variables started to be researched.To get more news about WikiFX, you can visit wikifx official website.

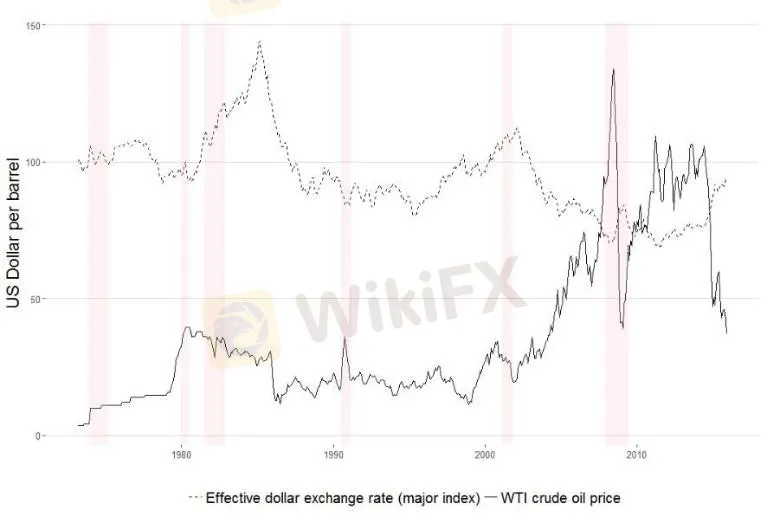

Because the pricing of crude oil is made in American dollars internationally, changes in oil price directly affect the exchange rates of the countries. This point especially led the researches about the effects of oil price changes to focus on its effects over exchange rates.Policymakers, academics and journalists have frequently discussed the link between oil prices and exchange rates in recent years—particularly the idea that an appreciation of the US dollar triggers a dip in oil prices. Empirical research is not so clear on the direction of causation, as there is evidence for bi-directional causality. Some studies find that an increase in the real oil price actually results in a real appreciation of the US dollar, while others show that a nominal appreciation of the US dollar triggers decreases in the oil price. Figure 1 illustrates the link between the nominal West Texas Intermediate (WTI) crude oil price and the US effective dollar exchange rate index relative to its main 7 trading partners.

The terms of trade channel mostly focus on real oil prices and exchange rates, while the wealth and portfolio channels propose an effect from the nominal exchange rate to the nominal oil price. The expectations channel allows for nominal causalities in both directions.

1. The impact of oil prices on exchange rates

The terms of trade channel were introduced in 1998. The underlying idea is to link the price of oil to the price level which affects the real exchange rate. If the non-tradable sector of a country A is more energy intensive than the tradable one, the output price of this sector will increase relative to the output price of country B. This implies that the currency of country A experiences a real appreciation due to higher inflation. Effects on the nominal exchange rate arise if the price of tradable goods is no longer assumed to be fixed. In this case, inflation and nominal exchange rate dynamics are related via purchasing power parity (PPP). If the price of oil increases, we expect currencies of countries with large oil dependence in the tradable sector to depreciate due to higher inflation. The response of the real exchange rate then depends on how the nominal exchange rate changes, but relative to the impact of any changes in the price of tradable (and non-tradable) goods described above. Overall, causality embedded in the terms of trade channel potentially holds over different horizons depending on the adjustment of prices.

The underlying idea of the portfolio and wealth channel is based on a three country framework. The basic idea is that oil-exporting countries experience a wealth transfer if the oil price rises. The wealth channel reflects the resulting short-run effect, while the portfolio channel assesses medium- and long-run impacts. When oil prices rise, wealth is transferred to oil-exporting countries (in US dollar terms) and is reflected as an improvement in exports and the current account balance in domestic currency terms. For this reason, we expect currencies of oil-exporting countries to appreciate and currencies of oil-importers to depreciate in effective terms after a rise in oil prices. There is also the possibility that the US dollar appreciates in the short-run because of the wealth effect - if oil-exporting countries reinvest their revenues in US dollar assets. The short and medium-run effects on the US dollar relative to currencies of oil-exporters will depend on two factors according to the portfolio effect. The first is the dependence of the United States on oil imports relative to the share of US exports to oil-producing countries. The second is oil exporters relative preferences for US dollar assets. Figure 3 summarizes the wealth and portfolio channels.

2. Common factors driving oil prices and exchange rates

Having already explained the role of inflation, Figure 2 incorporates other common factors including GDP, interest rates, stock prices and uncertainty. A full analysis of all possible linkages and other potential factors is beyond the scope of this paper, but a few important channels are worth mentioning. GDP and interest rates both affect exchange rates and oil prices, and are also interrelated: Monetary policy reacts to GDP fluctuations while interest rate changes affect GDP through total investment and spending. An increase in GDP, all else equal, results in an increase in the oil price. Effects on exchange rates are less clear for both interest and exchange rates. A relative increase in domestic interest rates should for example depreciate the domestic currency according to uncovered interest rate parity, but the empirical evidence has demonstrated that an appreciation is frequently observed instead, reflecting the notorious forward premium puzzle. Another major influence on both the macroeconomic environment and exchange rate dynamics is the degree of uncertainty. A domestic appreciation of the exchange rate might result from uncertainty, if participants expect a currency to act as a safe haven.

Under the theories explaining the relationship between oil price and exchange rate, we see the basic supply-demand relationship. When the price of oil increases, firstly demand for dollar will increase in oil importing countries leading dollar to appreciate, but then to buy the dollar their demand for their local currencies will increase leading appreciation of their local currencies, which causes the exchange rate to depreciate. Also after getting the payment, the supply of dollar will increase in oil-exporting countries leading dollar to depreciate which causes a decrease in exchange rate, but here there are two possible follow up situations. If the oil-exporting country increases their goods import because of the depreciation of dollar, demand for the dollar will increase in the country leading dollar to appreciate causing an increase in exchange rate. However, if the oil-exporting country can‘t/doesn’t increase their goods import, then exchange rate will remain in a decreasing trend because of the depreciation of dollar.

Researchers built a theoretical dynamic partial-equilibrium portfolio model of an oil price increase influence on exchange rates in a world consisting three countries: United States of America, Germany and OPEC. According to this model, the short-run and the long-run effects of the oil price increase will be opposite such as an increase in oil price at first induces dollar appreciation but then it turns into dollar depreciation. The effect of an oil price increase on exchange rate depends on “the share of local currency in OPEC‘s portfolio”, “the share of country’s goods in OPEC imports”, and “the country‘s share in world oil imports” in this model. In the model oil imports are exogenously fixed so the effect of oil price increase will also be affected by the OPEC’s spending preferences of the money generated from oil sales. For instance; if OPEC prefers dollar payment but German goods, then the value of dollar will increase in the short-run, however will decrease in the long-run.

评论

发表评论